It might be hard to remember, but 2022 started strong. With interest rates still hovering below 4% and home prices higher than ever, the first quarter offered good business for the mortgage industry. Total originations hit $859 billion in the first three months of the year, although uncertainty bloomed as interest rates began to creep up.

The wild growth of mortgage originations in 2020 and 2021 came to an end in the second quarter as rates continued to climb and the number of closed loans slowed significantly. The year ended with about $2.2 trillion in originations, roughly half that of 2021. In this industry, ups and downs are expected. After a two-year rocket launch, however, it hurt to come back down to earth.

The mortgage industry lost a lot of good people in 2022 as companies were forced to make difficult decisions to stay afloat in the challenging market conditions. Many originators have now moved on to other careers and we wish them nothing but the best.

Those who remain are being clever with lead generation and sales techniques. They have strong foundations in their communities and with their referral partners. While the year was tough, it represented a return to a relatively normal market after the boom caused by the post-pandemic economy.

Even though they may seem low in comparison to the past two years, it’s important to note that this year’s volumes are the third highest ever seen in Scotsman Guide’s Top Originators rankings. Reclaiming the No. 1 spot in the Top Dollar Volume rankings is Shant Banosian of Guaranteed Rate with $925 million in origination volume. Banosian was last in the top spot in our 2020 rankings, which he earned with $915.7 million in business during the 2019 production year.

Mark Cohen of Cohen Financial Group took second place, climbing five spots from last year. He originated $751.4 million, far above his third-place volume of $583.9 million in 2019. And third place went to Ben Cohen of Guaranteed Rate, with $646.4 million in loan volume, besting his 2019 volume of $638.9 million.

A few originators managed to increase their volumes from last year, including Mark Goodwin of First National Bank. Goodwin soared from 59th place in the 2022 rankings to sixth place this year, boosting his volume by $100 million to $475.7 million. Similarly, Parker Borofsky of Movement Mortgage leapt from No. 122 to No. 17, increasing her origination volume by nearly $20 million to $323.1 million.

On the following pages, you’ll find the top 500 originators by total dollar volume, as well as the top 75 by non-QM origination volume. Nonqualified mortgages have gained steam, especially in a challenging market, as nontraditional loan products open up more opportunity for business. Although volumes have predictably decreased this year across many of the rankings, the cutoff to make the Top Non-QM Volume list fell by less than $1 million. Each originator on the list closed more than $23 million in nontraditional products while the top five combined to close more than $1 billion in these products.

While we can only showcase a few hundred in print, thousands more originators who submitted and closed either 100 loans or $40 million in volume are included in our online rankings. The full rankings are available now on scotsmanguide.com. Find yourself and tag us on social media @scotsmanguide.

Throughout the year, Scotsman Guide will print additional rankings content, beginning with next month’s Top Women Originators. Follow along through the end of the year for content like Top Veteran Originators, Top Emerging Stars and State Champions. And for a sneak peek at lists like Top Mortgage Brokers, Top Purchase Volume and Top Refinance Volume, visit the online rankings at scotsmanguide.com.

In 2023, as we face an uncertain economy, originators are going back to basics. Build community, take your Realtor partners out for lunch, and educate yourself and your clients on all available loan products. Having a strong base of knowledge is the most common piece of advice given by Scotsman Guide’s Featured Top Originators, who we interview throughout the year.

Take some time for self-care too, however that looks for you. Maybe it’s a fishing trip, a bubble bath or a walk through your neighborhood with family. Remember, a career in this industry is about the long game. Survive the downswings to experience the upswings.

Scotsman Guide is here to offer resources and advice to get you through what is expected to be another slow year. Flip through these pages for articles from industry experts and remember that you can always find more online. These industry-leading rankings are only possible because of our loyal subscribers. Thank you for your submissions and have a great month of April. See you all again next month for the celebration of our Top Women Originators.

— Hannah Darden, industry rankings editor

Modest decline expected for purchase originations

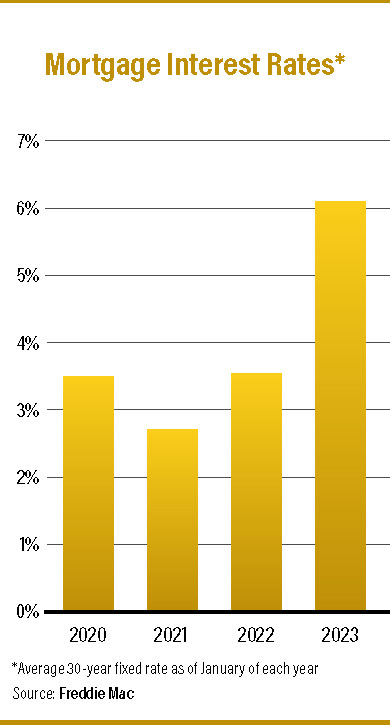

Rising interest rates caused a slowdown last year across all types of mortgage originations. While refinance volumes fell quickly, purchase loan volumes in the spring of 2022 were relatively robust, according to the Mortgage Bankers Association (MBA). But once interest rates topped 6%, and eventually 7%, the purchase market collapsed.

Purchase activity remained relatively light through the end of last year, even as rates dipped back below 7%. According to the MBA, purchase applications in the last few months of 2022 ran about 40% behind the pace of 2021.

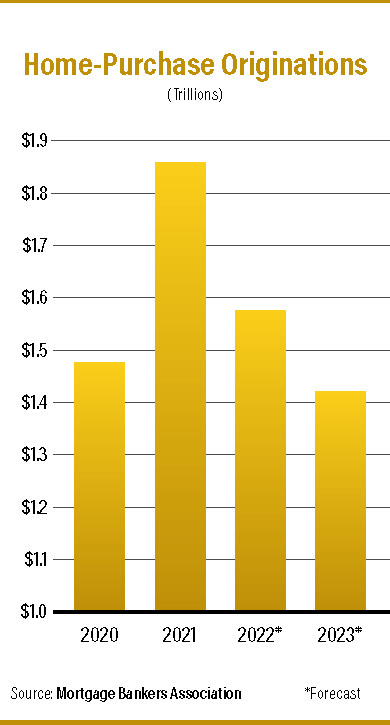

The MBA’s February 2023 forecast called for about $1.42 trillion in purchase originations this year, a modest pullback from the 2022 estimate of $1.58 trillion. Purchase originations by dollar volume and units are each expected to decline. But the MBA predicted that housing demand should be sustained for years by the 50 million Americans between the ages of 28 and 38, who are reaching prime ages for first-time homebuyers.

Mortgage rates will depend on broader economic performance

Interest rates rose sharply throughout 2022 and began to moderate this past December. According to Freddie Mac, the weekly average interest rate for a 30-year fixed loan was 6.32% as of Feb. 16, 2023, a steep hike from 3.92% a year earlier. But the 6.32% figure does represent a significant decrease from the November 2022 peak of 7.08%. The interest rate decline in the final month of 2022 led to a rise in mortgage applications, according to data from Fannie Mae.

If the U.S. economy experiences a downturn as expected in early 2023, the Federal Reserve may start to cut rates by midyear, Fannie Mae economists predicted. But if a recession does not occur, the labor market remains strong and wages continue to grow, the Fed could continue to tighten policy. This scenario could lead to mortgage rates rising back above 7% in 2023.

It’s hard to know for sure what this year will bring as the U.S. economy continues to wrestle with inflation. According to Fannie Mae’s forecast, it’s more likely that the mortgage industry will begin to see meaningful recovery in 2024, once this period of economic uncertainty has passed.

U.S. home prices are expected to decline

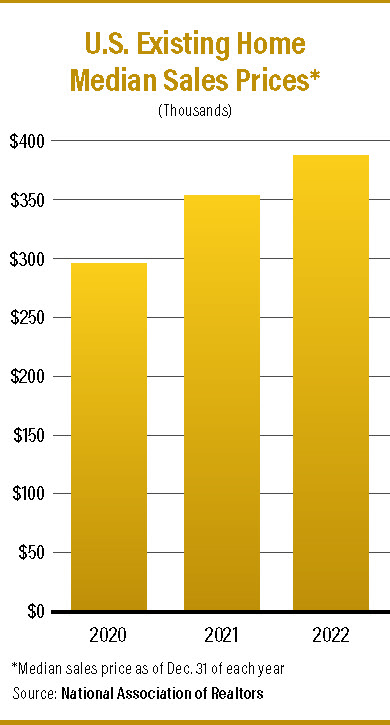

Median home prices have soared to historic highs over the past two years, leading to affordability challenges for would-be homebuyers. Fannie Mae’s January 2023 Home Purchase Sentiment Index found that only 17% of respondents believe that it’s a good time to buy a home.

“For consumers, the same affordability issues are persisting as they continue to indicate that high home prices and high mortgage rates make it a ‘bad time to buy’ a home,” said Doug Duncan, Fannie Mae senior vice president and chief economist.

Fannie Mae’s Economic and Strategic Research Group expects U.S. home prices to decline by 6.7% over the next two years. This decline, along with predicted lower mortgage rates in the next two years, should ease the housing affordability crunch. But a decline in home prices is likely to “lock in” current homeowners, which could lead to inventory challenges.

The National Association of Realtors (NAR) called for flat home price growth in 2023, with the median home price rising by only 0.3% to reach $385,800. NAR economists predicted that while most areas of the country will see small gains or declines in prices, expensive markets in California could see price reductions of as much as 10% to 15%.

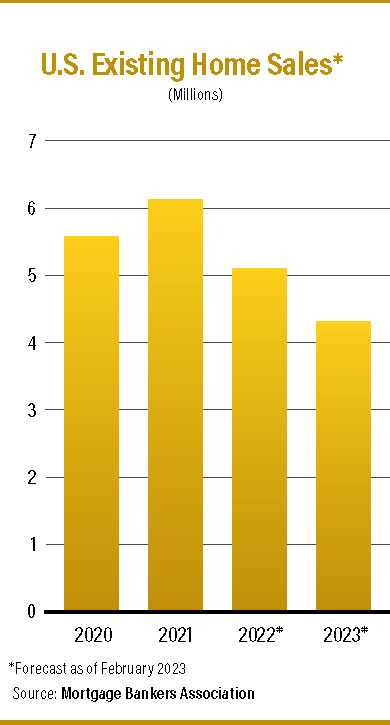

Home sales decline is expected to deepen

Economists are broadly predicting a decline in home sales in 2023, but there’s some division on how sharp the decline will be. Lawrence Yun, chief economist for the National Association of Realtors, forecast this past December that 4.78 million existing homes will be sold in 2023, a 6.8% decline compared to the 5.13 million sales in 2022.

That same month, the Mortgage Bankers Association revised its home sales forecast downward due to weak purchase loan application volumes. The MBA predicted 4.5 million existing home sales in 2023, a decline of nearly 13% from last year. The MBA’s forecast for new home sales was a bit more optimistic, with the 616,000 estimated sales representing a year-over-year decline of only 4%.

Redfin, meanwhile, called for about 16% fewer existing home sales this year, citing affordability issues, ongoing inflation and a potential recession. Redfin’s estimate of 4.3 million units sold would make 2023 the slowest year for sales since 2011.

Foreclosure filings pick up but stay below pre-pandemic levels

Foreclosure starts doubled in 2022 compared to the previous year, but they remained substantially below pre-pandemic rates, according to new figures from Attom Data Solutions.

Attom Data found 324,237 foreclosure filings nationally in 2022, up 115% from the 151,153 filings in 2021. Despite the jump, 2022 filings remained well below the nearly 500,000 filings in 2019 and represented an 89% decrease from the peak in 2010. Foreclosures were low in 2020 and 2021 due to federal foreclosure moratoriums and mortgage forbearance programs.

Despite more than 300,000 foreclosure starts, lenders repossessed only 42,854 properties through foreclosure in 2022. This represented a 67% increase from 2021 but was down 70% from 2019.

Rick Sharga, Attom Data’s executive vice president of market intelligence, said in the report that the majority of homes in foreclosure are not being repossessed by lenders because 93% of borrowers in foreclosure have positive equity to leverage. These homeowners are refinancing or selling their properties to avoid repossession. Sharga predicted that this trend will continue in 2023.

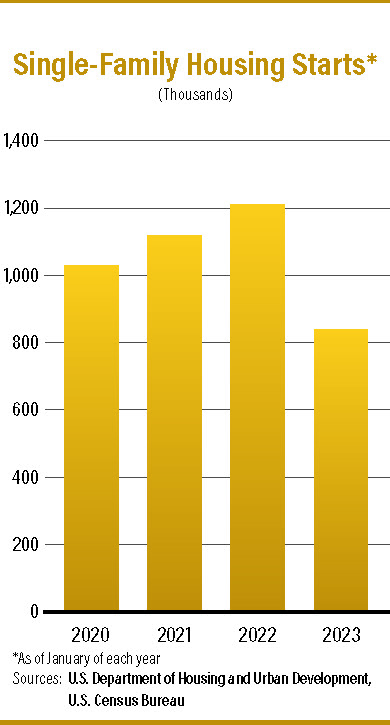

Single-family starts down, multifamily up during pandemic

Single-family housing starts ended 2022 down more than 10%, the first annual decline in more than a decade. While numbers are down significantly, it likely represents a correction in the homebuilding market, which is returning to pre-pandemic levels.

In January 2023, total housing starts were at a seasonally adjusted annual rate of 1.3 million, according to census bureau data. This represented a 4.5% decrease from the prior month’s rate of construction and a 21.4% decrease from January 2022. For pre-pandemic comparison, the seasonally adjusted annual rate of housing starts in January 2019 was 1.2 million.

While total housing starts are still above pre-pandemic levels, it’s important to note that single-family housing starts are down from pre-pandemic levels. Single-family starts had a yearly rate of 841,000 this past January, down 4.3% month over month and down 24.6% year over year. The strongest relative growth was in multifamily starts, which were at a rate of 457,000 in January, representing a 10% year-over-year decline but a 58% increase from pre-pandemic levels.

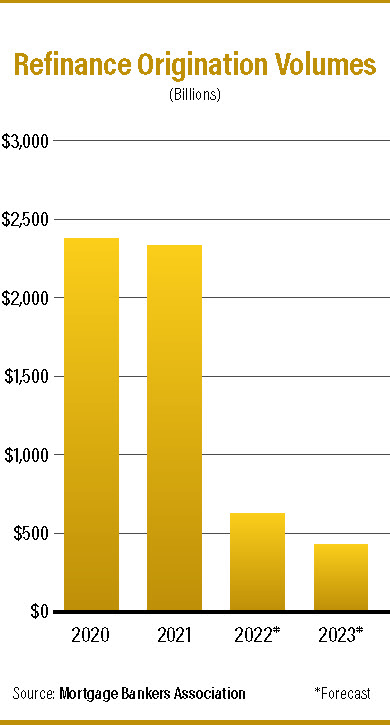

Another slow year lies ahead for refinances

It’s no secret how refinance originations fared in 2022. In a massive blow to the mortgage industry, rising interest rates after a period of historic low points dried up refinances almost completely.

The Mortgage Bankers Association (MBA) reported that refinance originations fell to $667 billion in 2022, down more than 70% from $2.3 trillion in 2021. The bulk of this origination volume came in the first two quarters of the year, before interest rates rose to prohibitive levels.

So, what’s next for refinances? The MBA forecast predicts another dry year for refis, with total originations reaching about $449 billion and the refinance share of the market dropping to 24%. Fannie Mae’s prediction was even more conservative, projecting $367 billion in refinance originations this year. Either way, economists expect the refinance market to pick up again in 2024 after interest rates gradually decline throughout this year.

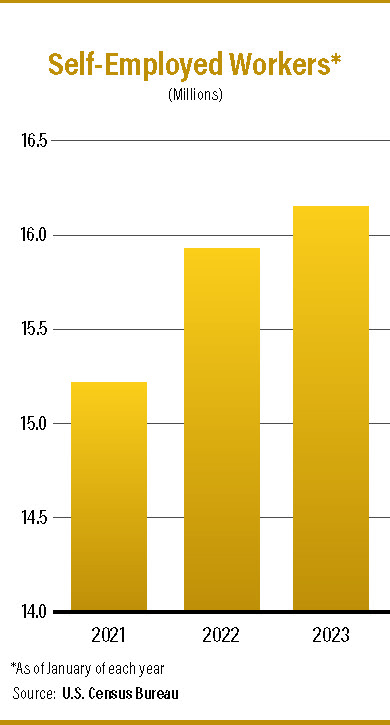

Self-employment up, poses Non-QM opportunities

Self-employed people make up about 10% of the 157 million employed workers in the U.S. as of January 2023, according to economic data from the U.S. Bureau of Labor Statistics. The bureau defines the self-employed as “those who work for profit or fees in their own business, profession, trade or farm.”

This definition can include business owners, independent contractors, gig workers, farmers and more. This type of employment has grown over the past 20 years and increased another 2% during the past year to include 16.2 million workers. The self-employed sector has recovered completely from pandemic-induced unemployment and is now rising above pre-pandemic levels.

Self-employed workers often don’t have W-2 income, making them good candidates for nonqualified mortgages (non-QM). In the current housing market, these workers could offer leads to the originators willing to educate themselves on non-QM products.